AUTUMN 2021

TOPICS IN OUR NEWSLETTER THIS QUARTER

APPLICATIONS OPEN FOR RESURGENCE SUPPORT PAYMENTS (RSP)

Businesses affected by the change in COVID alert levels that started on 28 February can now apply for the second round of the Resurgence Support Payment (RSP).

Applications opened at 8am on the 8th March 2021. Applications will close one month after the whole country returns to alert level 1.

Businesses can apply for the RSP through myIR.

This payment is in addition to the RSP for businesses affected by the change in alert levels from 14 to 21 February, for which applications closed on the 22nd March 2021.

Businesses affected by both alert level changes can apply for each of the payments.

For more information about the Resurgence Support Payment, go to

https://www.ird.govt.nz/updates/news-folder/resurgence-support-payment

For more information about all the support available to businesses, go to https://www.business.govt.nz/covid-19/financial-support-for-businesses/

How to apply in myIR:

- Login to your myIR account

- Navigate to the client’s account (the IRD number applying for support)

- Next to I want to… click More>

- Under Other Actions click Apply for Resurgence Support

TOURISM TRANSITIONS FUND

If you operate an Auckland tourism business, you could be eligible to access fully funded expert advice through the Government’s Tourism Transitions Fund. The temporary fund provides tourism business owners up to $5,000 excl. GST in funding, which can be used across one or more key areas of support based on your current business needs.

The fund is available via the Government’s Regional Business Partner (RBP) Network. Auckland Unlimited is the RBP delivery partner for Auckland.

Who should apply?

If your tourism business meets all the initial criteria below, you can start an application today.

- Fewer than 100 full-time equivalent employees;

- GST-registered in New Zealand;

- New Zealand Business Number (NZBN);

- Operating in a commercial environment;

- Privately owned business or a Māori Trust or incorporation under the Te Ture

Whenua Māori Act 1993, or be a similar organisation managing Māori assets under multiple ownership.

As part of the application process, an Auckland Unlimited business advisor will contact you to discuss your business needs and eligibility for funding. If your business is eligible, the value of funding allocated is determined by your Auckland Unlimited business advisor, based on your current business needs.

PROPOSED CHANGES TO THE BRIGHT-LINE TEST & INTEREST DEDUCTIONS ON INVESTMENT PROPERTY

The Minister of Finance, Hon Grant Robertson, has announced proposed changes for

residential property acquired on or after 27 March 2021. The proposed changes include:

- extending the bright-line test to 10 years

- amending the main home exclusion which would require tax to be paid on gains made for periods the property is not used as the owner’s main home

- allowing newly built homes to use a 5 year bright-line test

- not allowing property owners to claim interest on loans used for residential properties as an expense against their income from those properties

This would start from 1 October 2021, and would also be phased in over 4 years for existing properties.

YOUR CHECKLIST TO KEEP TAX TIME LOW-STRESS

First things first

Talk to your accountant or bookkeeper. They’ll tell you what you need to do before 31 March including what you can claim for and what you can’t. Remember, tax time is busy for them too, so the more prepared you are, the smoother the process, and the better the result.

File your return on time. Don’t waste your hard-earned cash on unnecessary interest and penalties. Get your accounts up to date, tidy up loose ends and file on time.

Your assets and stock

Review your inventory. The value of your stock affects your business’s taxable profit. Do a meticulous stocktake before year-end. Get rid of any out-of-date or damaged items and write them off.

Extra assets on board? Year-end is the time to ditch surplus assets. If you can sell them, great, otherwise write them off.

Your spending

Sooner rather than later. If you’re planning to buy any new equipment or assets, do it on or before 31 March (rather than 1 April) to reduce your taxable income and gain a full month’s depreciation.

Got invoices and receipts for your expenses? It can be tricky to keep track of everything so if you’re not already, go digital. Scanning receipts and saving electronic invoices in the cloud saves time and space.

Your staff

Payroll up to date? Now’s the time to check your payroll system only includes current staff and that all their details are correct. Ensure former staff don’t have access to company systems.

Remember tax on bonuses: Special bonuses this time of year can be a great way to reward and motivate staff, just remember to get the tax right on any lump sums made. Also keep in mind any bonuses for the current year, and holiday pay or long service leave paid out within 63 days after 31 March can be deducted against your current year income.

IMPORTANT CHANGES THAT MAY IMPACT YOU

There are some changes to legislation that may impact you. They fall into 5 main groups:

- a new top personal income tax rate of 39%

- increased disclosure requirements for trusts

- increased minimum family tax credit threshold for the 2020–2021 tax year

- clarified more generally that Inland Revenue can request information solely for tax policy development purposes, and

- changes to the Small Business Cashflow Scheme.

The new top tax rate

A new top tax rate of 39% will apply on personal income in excess of $180,000 for the 2021-2022 and later tax years. For most taxpayers this begins on 1 April 2021.

Clients who are provisional tax payers may need to adjust their provisional tax payments throughout 2021 to account for the larger year-end tax bill.

There are corresponding changes to other tax types to align with the 39% rate. These can be found in the table below.

Increased disclosure requirements for trusts

Trusts will be required to provide more information on their annual returns for the 2021-2022 income year onwards, including distributions and settlements made in the income year, profit and loss statements and balance sheets. This ensures Inland Revenue has a clear picture of how a trust is being used and whether the usage changes as a result of the personal income tax rate change.

The Commissioner can also request the information from trusts for prior years back to the 2013-2014 tax year as appropriate. This allows for comparable information to be gathered.

The increased disclosure requirements do not apply to non-active trusts, charitable trusts and trusts eligible to be Māori authorities.

Minimum family tax credit

The annual rate minimum family tax credit (MFTC) threshold will increase from $27,768 to $29,432 for the 2020-2021 tax year and subsequent years which is a maximum of $32 per week extra. To get this payment customers must work for salary or wages and not be self-employed.

IRD began paying the higher rate in weekly or fortnightly payments from late December 2020 to customers who receive payments throughout the year. All MFTC customers will have any unpaid increase from 1 April 2020 included as part of their end of year square up. IRD will send a Notice of Assessment after the end of the tax year, around June/July 2021. That Notice of Assessment will indicate if the customer has an overall refund or bill once everything is taken into account.

The Small Business Cashflow Scheme changes

Applications will remain open until 31 December 2023.

The loan will now be interest free for 2 years (up from 1 year), and restrictions on how the loan can be used have eased. As well as spending on core operating costs, businesses will be able to choose to use the loan to invest in their business, helping it to adapt to the impact of COVID-19.

There are also changes to the eligibility criteria in the following 4 areas:

- When the business was established

- The decline in revenue test

- Employee number test

- Re-borrowing

The changes will be in effect from 28 January 2021. Note that the change in the decline in revenue test will significantly change which businesses are eligible as the time period will no longer include the April 2020 lock down. It is best to view the full changes on our website at ird.govt.nz/updates/news-folder/upcoming-changes-to-the-eligibility-criteria-for-the-small-business-cashflow-scheme

Contacting clients

To ensure customers are aware of these changes, and how they may be impacted, IRD will be directly contacting those affected. IRD will ask clients to contact their accountants for advice in the first instance if they have any questions.

There is more detail on the new look tax policy site taxpolicy.ird.govt.nz

CORRESPONDING CHANGES TO OTHER TAX TYPES TO ALIGN WITH THE 39% RATE

| Impacted Area | Detail | New rate | From |

| Secondary tax codes | A new tax code (SA) for secondary employment earnings for an employee whose total PAYE income payments are more than $180,000. | 39% | 1 April 2021 |

| Extra pays | For extra pays for employees with taxable income exceeding $180,000. | 39% | 1 April 2021 |

| Fringe benefit tax (FBT) | A new top FBT rate will apply to all-inclusive pay exceeding $129,680. | 63.93% | 1 April 2021 |

| Resident withholding tax (RWT) | The Bill introduces a new RWT rate that mirrors the new top personal rate. | 39% | 1 October 2021 |

| Employer superannuation contribution tax (ESCT) | A new rate threshold will apply on superannuation contributions made for employees whose ESCT rate threshold amount exceeds $216,000. The ESCT rate threshold amount comprises an employee’s pay as well as gross employer contributions made in the preceding tax year. If the person was not an employee of the employer for the full preceding tax year, then it is an estimate of the employee’s pay and gross employer contributions for the tax year in which the contribution is made. | 39% | 2021-2022 and later income years |

| Retirement savings contribution tax (RSCT) | A new 39% rate will apply on RSCT where a saver’s taxable income in either of the two previous income years exceeded $180,000. Certain eligible contributing entities are required to deduct RSCT from contributions made to approved retirement schemes for their shareholders or members. | 39% | 1 April 2021 |

| Māori authority distribution | The standard rate remains unchanged at 17.5%. A taxable Māori authority distribution that is more than $200 where the Māori authority does not have a record of the IRD number of the member to whom the distribution will be subject to tax at a rate of 39% (currently the existing top rate of 33%). | 39% | 1 April 2021 |

MINIMUM WAGE INCREASE

SICK LEAVE

For those of you who are wondering about the status of the statute with regard to the proposed increase in sick leave days, please read on.

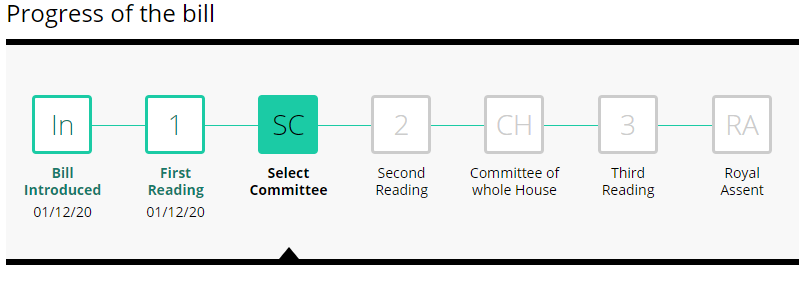

This become effective 2 months after it is passed as a law.

The Bill was introduced on 1 Dec 2020 and the same had the first reading.

It is with the select committee at this stage. The public submissions were closed by end of January and the committee is expected to report back by 6 Apr 2021. The further stages are as below:

It has to make a bit of a ground before it is stamped!

One important thing to note – Employees shall receive the increased sick leave entitlement on their next sick leave entitlement date after the law commences (it is not that all employees receive the additional sick leave on the same day).

If you have any questions on this please chat to your usual contact at JACAL.

FOLLOW US ON SOCIAL MEDIA

Johnston Associates has decided to provide more regular information via social media channels – namely Facebook and LinkedIn. We will continue to publish our quarterly newsletter, but you will find more regular and timely information through these channels.

So choose your preferred outlet by clicking on one of the buttons below, and don’t forget to follow us!

IMPORTANT PAYMENT DATES TO REMEMBER

MARCH 28th 2021

- Your GST return and payment is due for the taxable period ending February

MARCH 31st 2021

- Income tax returns are due if you have an extension of time

APRIL 7th 2021

- 31 March 2020 End-of-year income tax and Working for Families payments are due if you have an extension of time to file your income tax return

APRIL 20th 2021

- Employer deductions payment due for March for small to medium employers

MAY 7th 2021

- Your GST return and payment is due for the taxable period ending 31 March

MAY 20th 2021

- Employer deductions payment due for April for small to medium employers

MAY 28th 2021

- Your GST return and payment is due for the taxable period ending 30 April

MAY 31st 2021

- Your FBT quarterly return and payment are due for the period ending 31 December if you have a March balance date

- Your FBT annual return and payment are due if you file FBT annually

Disclaimer – While all care has been taken, Johnston Associates Chartered Accountants Ltd and its staff accept no liability for the content of this newsletter; always see your professional advisor before taking any action that you are unsure about.