AUTUMN 2022

TOPICS IN OUR NEWSLETTER THIS QUARTER

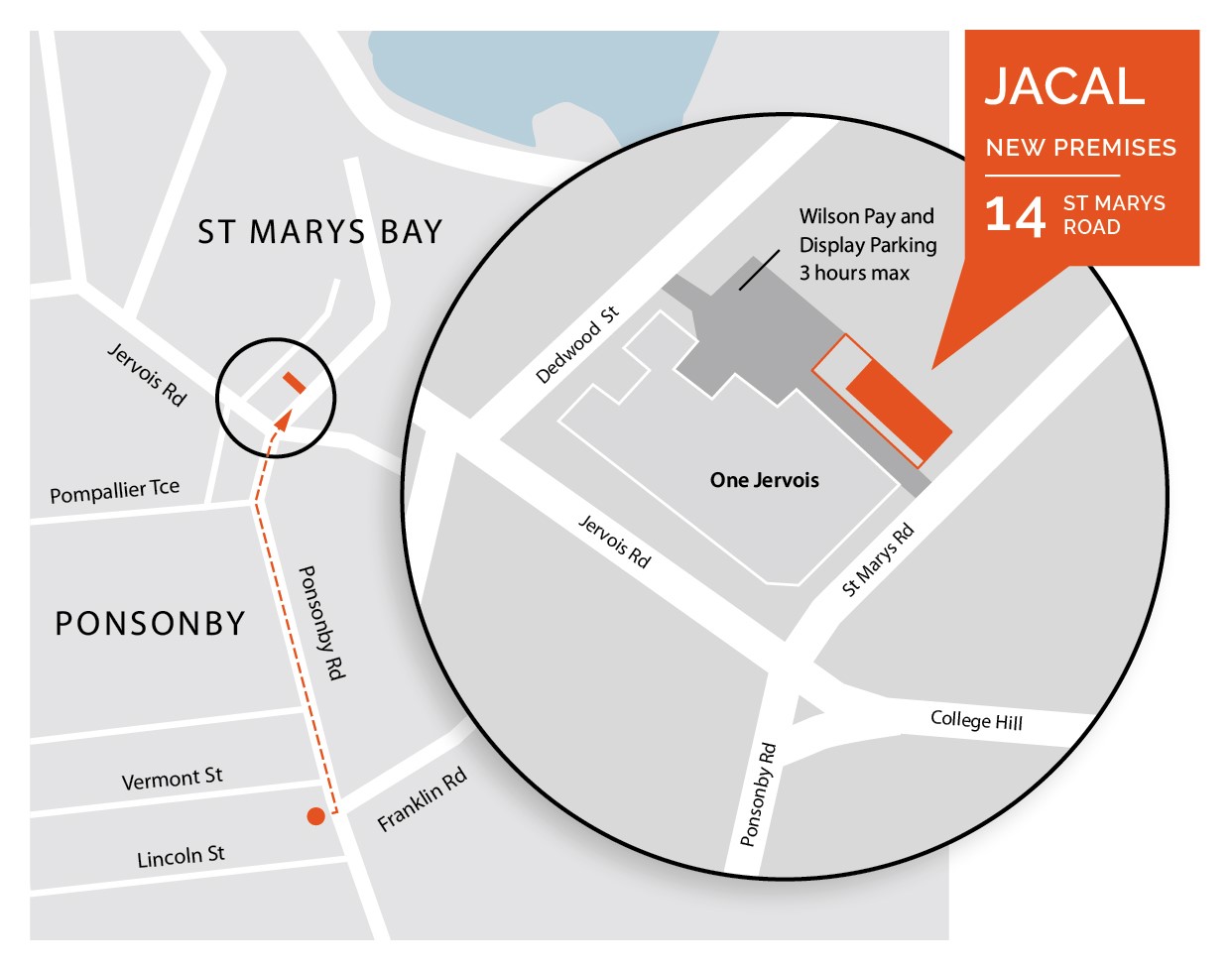

TAKE NOTE – WE ARE MOVING OFFICE

GET UP TO SPEED WITH EMPLOYMENT LAW CHANGES

- From 1 April, the minimum wage rate increases from $20 per hour to $21.20. Communicate the change with your employees in writing and if you have staff on salary, make sure their total remuneration meets the requirements.

- The Holidays Act is getting revamped bringing new ways of calculating holiday pay and other leave entitlements and the ability for employees to take annual holidays in advance. Jump on MBIE’s website for more information.

- This year sees the addition of a new public holiday, Matariki, to be marked on Friday 24 June.

- We expect to see a fair pay agreements Bill introduced this year. People will have an opportunity to comment on the Bill during the Select Committee process

- Dependent contractor protections are under review by MBIE with measures expected to include extending statutory minimum entitlements for leave and ensuring dependent contractors have the right to bargain collectively. Watch this space!

We’ll keep you up to date as further developments are announced.

COMPANY RESCUE PACKAGES

Credit: Peter Speakman from Speakman Law

There are four forms of potential rescue packages available to companies that become over-burdened by debt. A fifth, the debt hibernation scheme that the Government included in its 2020 business support initiatives, expired late last year.

The forms of rescue packages are compromises with creditors, voluntary administration, approved hive downs and formal schemes of arrangement. I do not discuss schemes of arrangement, for the reason that they require court approval and that fact alone limits their suitability as a rescue mechanism for excessively indebted companies, where survival is often predicated on a speedy solution. In my experience, schemes of arrangement are more often used in a takeover setting or a reconstruction of shares to reflect a planned reorganisation of business divisions. I have not seen them used to effect a debt compromise solution, though their scope certainly permits that.

Perhaps the most commonly used form of rescue package is a formal creditors compromise. Where a compromise is achieved, all creditors are bound by its terms and the company is protected against an individual creditor (or group of creditors) taking debt recovery steps against it. This result can be achieved relatively simply and without any need for court approval.

To be successful, creditors must of course be convinced of the merits of the proposal. Inevitably, in the minds of creditors this precipitates consideration of whether there is merit in a liquidator investigating potential claims against directors. It also necessitates that creditors are convinced of the steps to be taken to restore the company’s fortunes. Inevitably, this demands an offer to inject fresh capital into the company as the persuasive element in order to gain creditor support. The need to offer a cash injection will be greater wherever there are potential claims against directors made by a liquidator.

In practice, essential to the success of a creditors compromise is a high degree of transparency as between the management team and the creditors. This in turn demands that the creditors are a small group who are well known to the directors or management team, thereby enabling the merits of the compromise proposal to be openly and frankly discussed with them in advance.

The process for implementing a compromise proposal is relatively straight forward. The usual course is for the Board to put together a proposal (either an offer to repay creditors so many cents in the dollar, or seek a moratorium, or both) and send it to all creditors together with a statement of the amount owing to each creditor, their voting entitlement and the reasonably foreseeable consequences for creditors if the proposal is approved. The proposal will be approved if passed by a majority in number representing 75% in value of the creditors, by class. Related shareholders, where owed monies by the company, should be treated as a separate class from other creditors.

No moratorium is available unless and until the proposal is approved. This factor may deter companies from pursuing a formal creditors compromise and instead create a preference for a voluntary administration. This course offers the advantage of gaining a moratorium until such time as a deed of company arrangement (DOCA) is put to creditors for approval. Again, the approval threshold for a DOCA is a majority in number representing 75% in value of the creditors or class of creditors voting.

Lastly, a less often used procedure is a hive down approved by the court under certain ‘phoenix company’ provisions in the Companies Act.

A phoenix company is a newly formed company that acquires the business of a company in liquidation, including taking its trading name. Arrangements of this type are restricted under company law in order to protect creditors of the ‘old company’. Nonetheless, they are permitted with court approval (essentially requiring fair value to be paid to the old company). For example, a hive down might be suitable where a company operates three stores profitably and wishes to close down another two stores that have ceased to be profitable.

YOUR CHECKLIST TO KEEP TAX TIME LOW-STRESS

First things first

Talk to your accountant or bookkeeper. They’ll tell you what you need to do before 31 March including what you can claim for and what you can’t. Remember, tax time is busy for them too, so the more prepared you are, the smoother the process, and the better the result.

File your return on time. Don’t waste your hard-earned cash on unnecessary interest and penalties. Get your accounts up to date, tidy up loose ends and file on time.

Your assets and stock

Review your inventory. The value of your stock affects your business’s taxable profit. Do a meticulous stocktake before year-end. Get rid of any out-of-date or damaged items and write them off.

Extra assets on board? Year-end is the time to ditch surplus assets. If you can sell them, great, otherwise write them off.

Your spending

Sooner rather than later. If you’re planning to buy any new equipment or assets, do it on or before 31 March (rather than 1 April) to reduce your taxable income and gain a full month’s depreciation.

Got invoices and receipts for your expenses? It can be tricky to keep track of everything so if you’re not already, go digital. Scanning receipts and saving electronic invoices in the cloud saves time and space.

Your staff

Payroll up to date? Now’s the time to check your payroll system only includes current staff and that all their details are correct. Ensure former staff don’t have access to company systems.

Remember tax on bonuses: Special bonuses this time of year can be a great way to reward and motivate staff, just remember to get the tax right on any lump sums made. Also keep in mind any bonuses for the current year, and holiday pay or long service leave paid out within 63 days after 31 March can be deducted against your current year income.

COVID-19 SUPPORT PAYMENT (CSP)

As previously noted in our last mail out three fortnightly COVID-19 Support Payments (CSP) are available via IRD, to support businesses or organisations experiencing a 40% or more drop in revenue as a result of COVID-19. The CSP payment is $4,000 plus $400 per FTE (up to 50 FTE). The maximum payment is $24,000. Sole traders without any employees receive up to $4,400.

Applications for the first payment are open for the period beginning 16 February 2022 and ending 4 April 2022.

Applications for the second payment opened at 8am on 14 March 2022 for the period beginning 7 March 2022 and ending 4 April 2022.

Applications for the third payment will open at 8am on 28 March 2022 for the period beginning 21 March 2022 and ending 4 April 2022.

Applications for all 3 CSPs will close on 5 May 2022.

Each CSP payment has a defined affected revenue period as follows:

- First CSP – 16 February 2022 to 4 April 2022.

- Second CSP – 7 March 2022 to 4 April 2022.

- Third CSP – 21 March 2022 to 4 April 2022.

To work out your percentage drop in revenue, compare the revenue in an affected revenue period to the revenue earned in the comparison period.

The comparison period is a 7-day revenue period in the 6 weeks between 5 January 2022 and 15 February 2022.

Importantly and alternatively, you can use a 7-day revenue period in the 6 weeks between 5 January 2021 and 15 February 2021.

Please note that this alternative period (5 January 2021 to 15 February 2021) will be available for applications made from 14 March 2022 onwards, for all three CSPs.

Businesses with highly seasonal revenue, may select a 7-day comparison period before 5 January 2022 and which may be from a past year, which reflects your typical revenue.

Income tax, expenses and GST on CSP payment

CSP payments are not included in your income tax return if they are used for business expenses, and you cannot claim a deduction for these expenses at the end of the tax year.

GST-registered businesses are required to return GST on the CSP payments. You can claim GST on items you paid for out of the payments you got under the CSP.

COVID-19 LEAVE SUPPORT SCHEME

The COVID-19 Leave Support Scheme is available to employers, including the self-employed, to help pay employees who must self-isolate because of COVID-19 and can’t work at home during that period.

To qualify for the Leave Support Scheme your employee will have been required to self-isolate for at least 4 consecutive calendar days.

Meaning your employees, can’t come into work because they are in one of the affected groups and must self-isolate, and can’t work from home.

The COVID-19 Leave Support Scheme payments:

- $600 for full-time workers who were working 20 hours or more a week.

- $359 for part-time workers who were working less than 20 hours a week.

THE SMALL BUSINESS CASHFLOW SCHEME (SBCS) UPDATED

The SBCS is to help small to medium businesses and organisations struggling with a loss of revenue due to COVID-19, applications are open until 31 December 2023.

Eligible your businesses or organisation can submit an application through myIR.

From February 2022, the SBCS base loan was increased to $20,000 (from $10,000). This means that for a new loans the total amount that can be borrowed will be $20,000, plus $1,800 per full-time equivalent employee (up to 50 employees). The loan repayment period remains 5 years (60 months).

Existing borrowers can apply for a top up loan of a further $10,000, plus any amount they were eligible for but did not take in their initial loan. This will be open for applications from 21 March 2022.

The first 2 years of existing and new loans will be interest-free provided the loan is not in default. Interest will apply at a rate of 3% per year on the remaining loan balance from the first day of the third year of the loan period.

UNABLE TO PAY YOUR TAXES ON TIME?

Please contact us now regardless of your fee payment status with us if you are unable to pay any of your taxes on time, we will see what can be arranged with IRD, it is best to contact us well before the tax due dates.

Update from TMNZ for clients using tax pooling, (please contact us if you are using another tax pooling or tax finance provider to check options)

IRD have now allowed 183 days after a taxpayers terminal tax date to settle 2021 income tax arrangements with TMNZ. Anyone impacted by COVID-19 now have 183 days after their terminal tax date to settle 2021 income tax arrangements with TMNZ, subject to meeting certain criteria. IRD announced it has extended the deadline, recognising the cash flow difficulties some taxpayers face due to Covid. There is also relief for taxpayers unable to determine their 2021 tax liability before their tax pooling deadline. TMNZ recommend customers apply for the extension as soon as possible, to avoid undue stress closer to the deadline.

FOLLOW US ON SOCIAL MEDIA

Johnston Associates has decided to provide more regular information via social media channels – namely Facebook and LinkedIn. We will continue to publish our quarterly newsletter, but you will find more regular and timely information through these channels.

So choose your preferred outlet by clicking on one of the buttons below, and don’t forget to follow us!

IMPORTANT PAYMENT DATES TO REMEMBER

MARCH 28th 2022

- Your GST return and payment is due for the taxable period ending February 2022

MARCH 31st 2022

- 2021 year income tax returns are due if you have an extension of time

APRIL 7th 2022

- 31 March 2021 End-of-year income tax and Working for Families payments are due if you have an extension of time to file your income tax return

APRIL 20th 2022

- Employer deductions payment due for March for small to medium employers

MAY 7th 2022

- Your GST return and payment is due for the taxable period ending 31 March 2022

- 2022 year third provisional tax instalment date

MAY 20th 2022

- Employer deductions payment due for April 2022 for small to medium employers

MAY 28th 2022

- Your GST return and payment is due for the taxable period ending 30 April 2022

Disclaimer – While all care has been taken, Johnston Associates Chartered Accountants Ltd and its staff accept no liability for the content of this newsletter; always see your professional advisor before taking any action that you are unsure about.