AUTUMN 2018

TOPICS IN OUR NEWSLETTER THIS QUARTER

WHAT SHAPE ARE YOUR END-OF-YEAR ACCOUNTS IN?

The end of the financial year can be either stressful or a seamless part of what you do. Ideally, your end-of-year accounts will confirm what you think your business has been doing for the past 12 months.

Be a good scout to avoid end-of-year migraine

Being prepared is the key to avoiding end-of-year financial drama and stress.

- First make sure you have all the documents we’ll need, such as PAYE statements, bank statements showing interest earned, dividend statements for shares, and receipts for expenses.

Don’t forget receipts for charitable donations. - Look at writing off old debts. Scrap redundant or worthless assets, so you get a deduction on your books.

- Print out profit and loss, balance sheet and general ledger listing reports and store them safely.

- Have a final look at your payroll reports. You don’t have to give summaries to your staff, but if you give them Earning Certificates, they can be used to check IRD information.

- Note odometer readings on vehicles and ensure logbooks noting business and personal use, mileage and costs etc. are in order.

- Dispose of obsolete stock by the year end or write it down to its net realisable value.

- Talk to us on any planned dividend payments, as managing imputation credits will be important.

- Finally, get us to work with you on reviewing your business plan and updating it for next year – and to review your accounting software.

We’ll probably adjust your reports or accounts. Once we’re done, lock all accounts relating to the financial year – and keep them secure.

SAFE AS HOUSES: STOP PRESS!

Revenue Minister Stuart Nash has confirmed the bright-line test on residential property sales will be extended from two years to five years. At present, income tax must be paid on any gains from residential property sold within two years of acquisition, with some exceptions (such as the family home). The extension means that profits from residential investment properties bought and sold within five years will generally be taxable.

To make this happen, changes to law are currently making their way through Parliament. It is expected these will receive Royal Assent in March. And it is expected that this will affect properties acquired on or after the date of Royal Assent.

We will have more for you on this when the legislation passes. Meanwhile, if you are in the process of entering into sale and purchase agreements to acquire property, please give priority to discussing the tax implications with us.

NEW LAW WILL MAKE DIRTY MONEY EASIER TO SPOT

Money laundering is big business in New Zealand. Every year $1.35 billion of fraud- and drug-related money is laundered through seemingly legitimate businesses. In response, the

Government introduced specific Anti-Money Laundering and Countering Financing of Terrorism legislation to address this risk.

Previously, only a few types of organisation had to comply with the legislation. Following amendments to this legislation passed last year, it is now confirmed that this legislation

extends to these groups taking effect from these dates (or earlier if the Government legislates by an Order in Council):

1 July 2018: lawyers, conveyancers and businesses that provide trust and company services

1 October 2018: accountants who provide particular kinds of business services

1 January 2019: real estate agents

1 August 2019: businesses trading in high-value goods, sports and racing betting

If you are in any of these categories, of course you must make sure that your business complies. We can point you in the right direction. But please also note that as your

accountant we are in one of the categories that must comply with the changes. And to do this, be aware that we will sometimes need to ask you for more information than we have in the

past. This is because we need to be able to document that we have verified your ID and both you and your business entities are all above board.

TAX RETURNS ABOUT TO GET EASIER

In April, IRD will also introduce payday reporting of PAYE information – that is, employers will need to report employee payments to Inland Revenue (IR) every pay run. To give you time to put systems in place, businesses will have a year before it becomes mandatory.

Hand in hand with that, IRD will begin collecting PAYE info for the 2018/19 year to allow prepopulation of income tax returns. That should make life a bit easier for SMEs. What’s more, the release of Working for Families is being brought forward to 2019, to coincide with tax returns being done under the new system, which – again – will make things simpler for SMEs.

PROVISIONAL TAX CHANGES EXPLAINED

We are fielding a few queries about the provisional tax changes that apply from the 2018 tax year onwards.

Below is a summary of the new rules for taxpayers who use the standard method to calculate their payments.

Smaller taxpayers (including companies and trusts)

Inland Revenue (IRD) has changed what it calls the ‘safe harbour’ provision.

If:

- Your actual income tax liability for the year is less than $60,000; and

- You paid the tax amount required as per the standard method at your three provisional tax dates.

Then:

- You will not be charged IRD interest if you did not pay enough provisional tax, provided you pay the final balance by your terminal tax date.

The safe harbour threshold was previously $50,000 and applied to individuals only.

Medium and larger taxpayers

The second change affects medium and larger taxpayers.

If:

- Your actual income tax liability is $60,000 or more; and

- You paid provisional tax for that year based on the standard method.

Then:

- You won’t be charged IRD interest if you paid the amounts of tax due as per the standard method at your first and second instalments, even if your actual liability is higher.

- The final balance will be due at your third provisional tax date. IRD interest applies on any underpayment or overpayment of tax from the third provisional tax date.

Capping the liability at the first and second instalments provides certainty, particularly if your income is volatile or seasonal.

Having the final balance due at the third provisional tax instalment is sensible because you should have a good estimation of your actual liability by then.

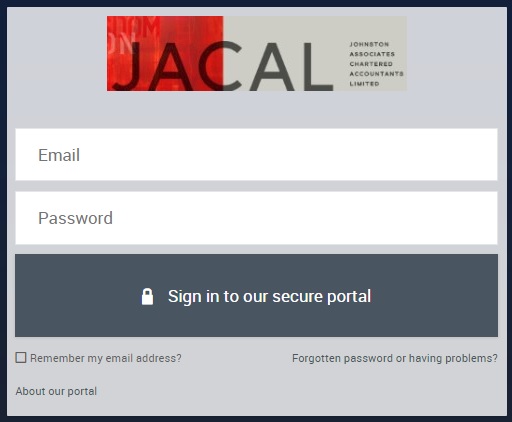

JOHNSTON ASSOCIATES LAUNCHES ONLINE PORTAL

Johnston Associates has launched an online portal which will enable our clients to complete secure online communication and signing of documents.

Your introduction to this portal will likely be to receive our annual terms of engagement, which you will be able to sign online.

Later on, for many of our clients we will be sending out your annual accounts package via the portal. Again, online signing of these will be possible, even when multiple signatures are required.

We hope this portal will improve your experience with Johnston Associates and make it easier for you to quickly and securely perform your review and signing of documents.

No action is required from you at this stage, but at some point you may receive an email notifying you that a document has been published to your portal account. We will then provide instructions on how to activate your account and authorise your device for online signatures.

IMPORTANT PAYMENT DATES TO REMEMBER

March 28th 2018

- GST – your GST return and payment are due for the taxable period ending 28 February

March 31st 2018

- Student loan repayments due for overseas-based borrowers

April 7th 2018

- 2017 income tax

- Working for Families Tax Credits

- Student loan repayments

May 7th 2018

- Provisional tax instalments – the third instalment of your provisional tax is due on 7 May if you:

– have a March balance date, and

– use the standard or estimation option to calculate your provisional tax payments - Student loan interim payments are due. The interim payments you make will be offset against your repayment

- GST – your GST return and payment are due for the taxable period ending 31 March

Disclaimer – While all care has been taken, Johnston Associates Chartered Accountants Ltd and its staff accept no liability for the content of this newsletter; always see your professional advisor before taking any action that you are unsure about.